Results-based Management, 6-month Report and Annual Report Writing

Speaker By:

Venue: Sunway Hotel, Phnom Penh

Date: 19 Jul-20 Jul 2016

Time:

Main objectives

- To build participants’ capacity in writing a clear and concise result based reports

- To promote partners’ confidence in tackling a professional report and deliver quality and result based 6 month report, annual report

Expected Outcomes

- Partner organizations developed their result based reporting capacity and were able to write clear and concise result based reports

Click here view Photos and Presentation.

Other Event Archives

DO NO HARM TRAINING OF TRAINERS

DO NO HARM TRAINING OF TRAINERS

Bi-Monthly Meeting

Today, the 253rd Bi-Monthly meeting was convened at Diakonia Center (KSSA/ICF). Cooperation Committee for Cambodia - CCC is pleased to warmly congrat and welcome five new members organization including ...

Prakas 464 on taxation for associations and NGOs

CCC is pleased to share you Prakas 464 on taxation for associations and NGOs in Khmer version and unofficial English translation. The Prakas dated on 12 April 2018, so some of you might receive it...

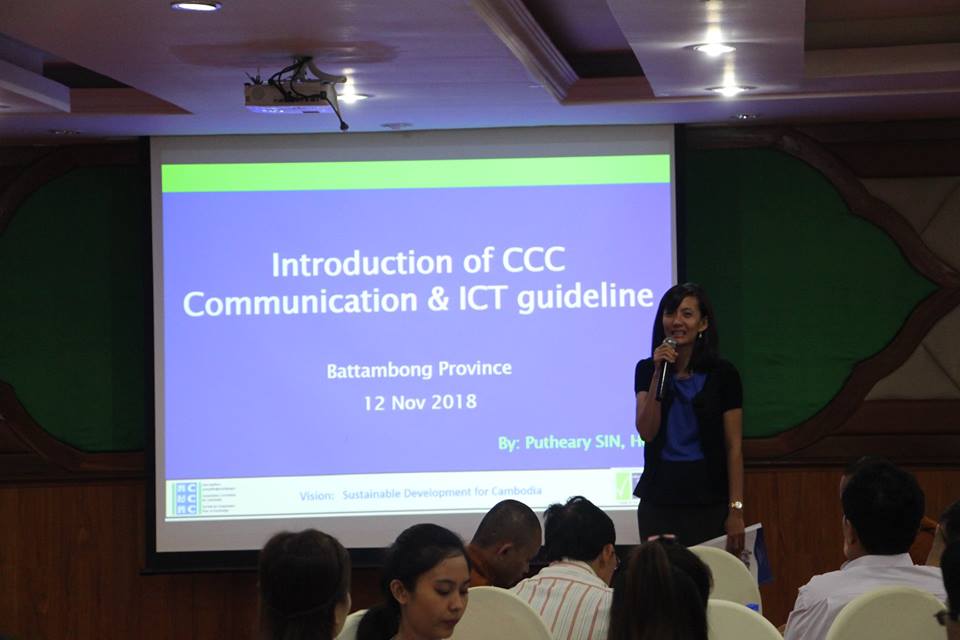

Sub-National Workshop on Communications and Do No Harm

The Cooperation Committee for Cambodia (CCC) organized Communications and Do No Harm (DNH) workshop in Battambang Province on 12 November 2018. The workshop was discussed on the need of members and provincial NGOs network related to the social media and communications as a whole.

We are very delighted to meet Mr. Samuel Hurtig, Head of Development Cooperation Section, and Ms. Camilla Monsine Ottosson

Today, we are very delighted to meet Mr. Samuel Hurtig, Head of Development Cooperation Section, and Ms. Camilla Monsine Ottosson, First Secretary-Democracy, Human Rights and Labour Market, at the Embassy of Sweden Phnom Penh to discuss on topic such as strategic partnership development.

Finance Learning Forum on “The Real Practice Taxation for Not-for-Profit Entities”

To Enhance understanding on tax compliance with non-for-profit entities. To learn and discuss the real practice of how to register TIN, VAT, tax on salary, withholding tax, and annual income tax. To strengthen relationship and network among finance practitioners and professionals for ongoing learning on Financial Management issues and good practice.